The very beginning of 2022 was unprecedented in Niagara real estate, with homes selling well over the asking price, in some cases hundreds of thousands of dollars over, with no conditions. This created a bidding wars and an unfortunately frustrating situation for so many buyers.

We knew back in January that the market was going to change due to interest rate hikes as well as the influx of inventory hitting the market.

And change, it did!

WATCH NOW: SHAWN DE LAAT BREAKS DOWN WHAT’S HAPPENING IN NIAGARA REAL ESTATE

Here in Niagara, we experienced our spring market in February / March, a little earlier than usual. As interest rates started go up, demand diminished, which we saw plainly at the tail end of March and into the beginning of April with very few showings on listings across the region.

What’s occurring right now is called a “correction” to the market. The prices we saw at the beginning of the year were not realistic to our area and as this correction happens, we’re beginning to see a decrease in price to compensate for rising interest rates. The foreign buyer’s tax in Ontario as well as the temporary freeze on non-residents purchasing property are just a few of the ways our government is stepping in to assist in this correction.

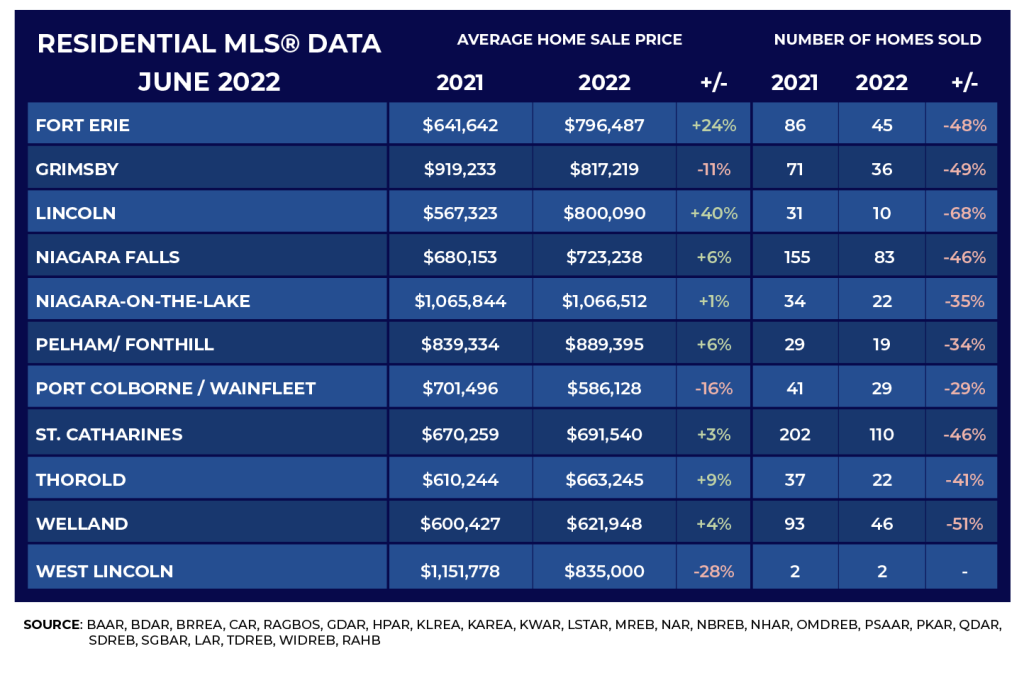

HERE’S HOW THE NIAGARA REAL ESTATE MARKET PERFORMED IN JUNE 2022

THE NIAGARA SUMMER REAL ESTATE MARKET

With summer in full swing, here’s what I think we’re going to see from now until September:

1. A lot of people going on holidays, taking break from their home searches

2. More interest rate hikes

3. Fewer sales

4. The market continuing to correct, with prices decreasing and homes sitting longer

5. A number of hesitant buyers, waiting to see how low prices will go and how high interest rates will go.

REAL ESTATE PREDICTIONS FOR FALL 2022

We do anticipate that by fall, prices will stabilize and they will finally hit a point that empowers buyers once again. We’re already noticing some of that right now with some of the pricing going on.

A lot of listings will come off the market because a number of sellers have missed the boat on the height of the Niagara market but maintained their expectation of selling price.

We’ll have a softening in inventory again

The new sellers & buyers coming into the market will already be accustomed to the prices and market activity the way it is

and then slowly we’ll start seeing gains in the market again.

This is why I’m encouraging buyers right now to do your due diligence, get your pre-approval and take advantage early before more demand comes to the market.

If you’re a seller and just have to sell your home and you’re not buying AND you can wait – I encourage you to wait. The market will come back in another 2-3 years once everything settles.

THE BUZZ AROUND ONTARIO REAL ESTATE

There is a narrative currently circulating, echoed by governments, economists and media that interest rates will go up, up, up, up and up. This is understandably creating a lot of fear and hesitation among buyers, as well as panic among some sellers trying to catch the fumes of the height of the market. Rates WILL go up, but likely not to the degree this narrative suggests. Most likely, the rise will slow or stop by the end of this year / early next year.

FIXED RATE OR VARIABLE – WHICH SHOULD I CHOOSE?

The other reality is this: come the end of next year, it’s a possibility that interest rates may have to drop to boost our economy again. That’s not being discussed right now because banks are recouping lost profit due to low rate lending during Covid. Now they have an opportunity, thanks to inflation, to raise interest rates and what this does is encourages borrowers to lock into fixed rate for fear of a spike.

Knowing rates will stabilize and eventually may come down, if you do decide to lock into a fixed rate, signing up for a 2 year is a good idea. Alternatively you can ride the ups and downs of the variable rate. I’m confident that in the next year or so rates will settle and push the market forward once again due to more palatable interest rates for buyers and investors. I’m so confident they’ll stabilize that I’m putting my money where my mouth is and riding that variable myself with the properties that I personally own.

ADVICE FOR BUYERS AND SELLERS

If you are a buyer right now, I encourage you NOT to listen to all the kerfuffle about interest rates. Please have an informed conversation with your mortgage broker, your bank and do your own research so you can make the best decision for you. Higher interest rates right now don’t necessarily mean you’ll be spending more money in the long run. Prices are very attractive, we haven’t seen this for a very long time in our market. Depending on your situation and given the amount of inventory on the market you may even find that now is the perfect time for you to purchase.

If you’re a person that has to sell your home AND buy another one, your time is now. Your home won’t be worth what it was back in January / February but it doesn’t mean you won’t still get a great price for it, or make a profit off of the sale. You should also take into account that the property you’re going to buy has reduced in price as well. It’s all relative. Whether you’re selling to buy up or buy down, the market is in great shape for you. There’s little competition, making a bidding war not likely and we’re in a position to add conditions on offers again, including a sale of property condition! A number of sellers, including several of my own sellers are willing to accept a good offer with a sale of property condition.

For those who have been sitting back waiting to see what’s what for three or four years before buying I’m telling you your time is now. Don’t let fear drive your decision because there are plenty of attractive opportunities.

Sellers who want to sell and cash out, if you CAN wait, wait. The height of the market has passed and if you hang on a little longer, the market is projected to upswing again in a few years, similar to what happened back in 2017.

With Canada’s plans for immigration, new constructions not nearly meeting the demand we have for housing and with a large number of new residents projected to settle into Niagara over the next 5-10 years, the demand will once again surge without the supply to feed it, thereby driving prices up.

If you’re looking for information, or guidance on buying or selling a home in Niagara, please don’t hesitate to call Davids & DeLaat and lean on us. We’re more than happy to set up a free home evaluation to discuss the market and to figure out what’s going to be right and best for you. Now may not be your time to buy or sell but we can educate you over the next few years to help you decide when IS your time.