Hello, Niagara!

Shawn DeLaat here with the Davids and DeLaat Real Estate Team with your January 2023 market update.

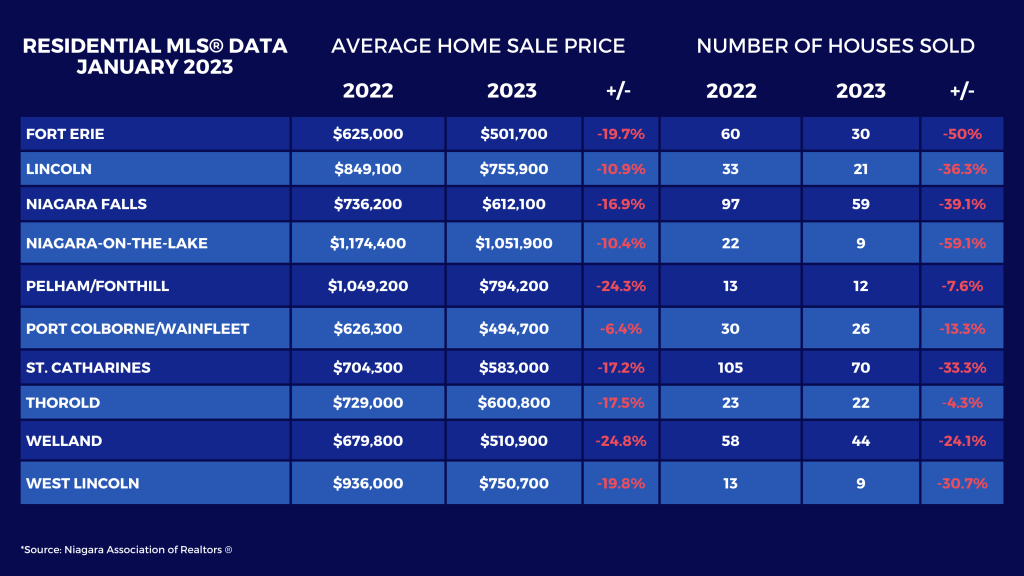

To put things in perspective for everybody, in February 2022, at the epic height of our real estate market, the average sale price for Niagara was $805,000. Obviously, throughout the year, interest rates kept rising, pushing prices down, which caused us to end the year in December 2022, with the average sale price being $570,000. So here we are today in January 2023, and the average sale price is $584,000. What that says is December appears to be the bottom of the market.

INVENTORY LEVELS ARE LOWER

I’ve been saying this for quite a while, but inventory levels are low. We are seeing this in our current market, with the lower entry level pricing houses ($400,000 to $600,000). There is seeming to be some competition again, and demand is growing as well. Demand not only locally, but demand from out of town. The outer lying markets, Toronto, Burlington and Hamilton are all getting very active, and once they get more active, a lot of that demand will be pushed to our market!

GOOD NEWS FOR SELLERS!

So what that means for sellers is that if you have a house that’s priced well to the current market standards, you’re going to sell relatively quickly. You have a much better chance of selling now than houses that were selling last year and we’re already noticing that because days on market is shrinking. The houses that are a little more tired and need a little more work, are lingering on the market, and this means buyers can get a better deal. If you’re a seller and you have a house like that, and you’re prepared to sell your house for spring, you should begin getting your house prepared. Do some fix ups and make your house stand out compared to others.

WHERE ARE WE NOW? JANUARY 2023 MARKET STATISTICS

WHAT DOES THIS MEANS FOR BUYERS?

What you need to know as a buyer is that you need to get out there! GET PRE-APPROVED NOW to try and catch the market before prices are going to start slightly jumping up! We are anticipating a stronger spring, but also spring will yield more inventory as well. A lot of people wait to list their homes for the nicer weather, so inventory levels will increase, but we will also have much stronger demand.

WHAT TO EXPECT IN 2023

If you are going to be a seller, it is going to be a pretty decent year for you! Buyers on the other hand, get prepared and get pre-approved. There will be some competition moving forward but what we’re seeing is the quality houses that get listed are selling very quickly! For the first time in almost a year, the market is slowly moving up in a now positive direction. Interest rates were raised earlier this month, as they went up 0.25%. Now, the Bank of Canada’s posted rate is 4.5%. What you need to know is that 6.7% is the variable rate, and most of the banks are around 5.5% with a fixed, closed five-year mortgage. Hopefully this provides a better outlook on what’s going on and what we’re going to be seeing in the future and coming months as demand grows and houses start to move a lot quicker.

Take advantage of the opportunity to purchase at a more affordable price! Contact us to discuss a selling strategy that’s custom fit for your home. Visit us on Youtube to learn more about these changes or schedule your free home evaluation to find out what your home could sell for in today’s market.